At A Glance

- Raydium delivers a fast, affordable and decentralized crypto trading experience on the Solana network.

- Raydium has its own liquidity pools and can leverage the Serum order book resulting in more liquidity for trading.

Decentralized exchanges, allowing users to trade digital currencies independently and anonymously are becoming increasingly popular. Those looking to trade crypto with fast transactions and at an affordable cost can use Raydium DEX, a dApplication built on the Solana network.

In this guide, we’ll introduce you to the Raydium DEX and give you an overview of its features. We’ll also show you how to use the exchange and discuss its advantages and shortcomings.

Here’s a breakdown of what we’ll cover:

- What is Raydium?

- How does Raydium work?

- Supported Tokens

- How to use Raydium?

- Is Raydium safe?

- Raydium Pros

- Raydium Cons

- Is Raydium the right fit for you?

What is Raydium?

Raydium is a decentralized exchange (DEX) that uses an automated market maker mechanism to allow its users to trade cryptocurrencies without relying on an intermediary or any other third-party by withdrawing and depositing assets from their liquidity pools. Built on the Solana Blockchain, Raydium is able to provide fast and cheap transactions, especially when compared to other decentralized exchanges than run on Ethereum.

Raydium has its own Liquidity Pools to which you can contribute in orderto facilitate trading and receive a portion of the fees in return. Its users can use Raydium to swap crypto assets using said liquidity pools and the Serum Solana exchange. You can also use Rayidum to earn rewards by taking part in yield farming or participating in fusion pools.

As an additional feature, Raydium has a native token, RAY, which can be earned by contributing to Raydium Farms and can be staked on the exchange to obtain additional rewards.

Furthermore, users can take advantage of Raydium to launch Solana projects.

How Does Raydium Work?

Raydium works as an Automated Market Maker, meaning that rather than matching trades using an order book as in a traditional exchange, it supports trades using liquidity pools. Users can trade freely and independently by contributing and withdrawing tokens from each cryptocurrency’s liquidity pool. Reserve assets are maintained constant in these liquidity pools to guarantee funds are available for trading.

However, there is a slight difference between Raydium and other AMM platforms. While in other AMMs trades are limited by the liquidity contained in their own liquidity pools, Raydium was built for the Serum DEX, allowing the platform to leverage on their central order book and the liquidity of its ecosystem.

Supported Tokens

Raydium supports SPL tokens, which are Solana blockchain tokens. Other non SPL tokens, such as Bitcoin and Ethereum, can be used on Raydium through Serum as wrapped tokens.

Raydium Fees

Users swaping crypto pairs using Raydium are charged a 0.25% transaction fees. Part of these fees go back into the liquidity pool and are distributed among liquidity providers as a reward. Another small portion of fees goes into the RAY staking pool to reward users participating in this activity.

However, if the trade is completed through Serum’s order book transaction fees are paid directly to the Serum exhcange. Serum fees can vary according to the amount of SRM held.

Finally, in both cases users are charged a network fee for using the Solana network, which are typically very affordable.

How to use Raydium?

To start using Raydium, you’ll need to create and connect a Solana wallet to the exchange. Some of the supported wallets include: Phantom, Solflare, Math, Bonfida, Sollet.io, Solong, Blocto and Ledger.

Before you get started, you’ll want to make sure your wallet has some SOL, since it is required to pay network transaction fees. While Solana fees are very affordable, it is recommended you keep a small amount of SOL in your wallet at all times to fund your trades.

Swaps

Raydium’s swap feature allows users to exchange one crypto token for another by relying on Serum and its own liquidity pools. Raydium executes the requested trade using the option that will be able to deliver the best deal for the user.

To start trading on Raydium, you will need to access the exchange through your web browser, go to the Swap tab and connect your wallet. From here you can select the crypto-pair, or the token you want to trade in and the one you want to get, for your swap.

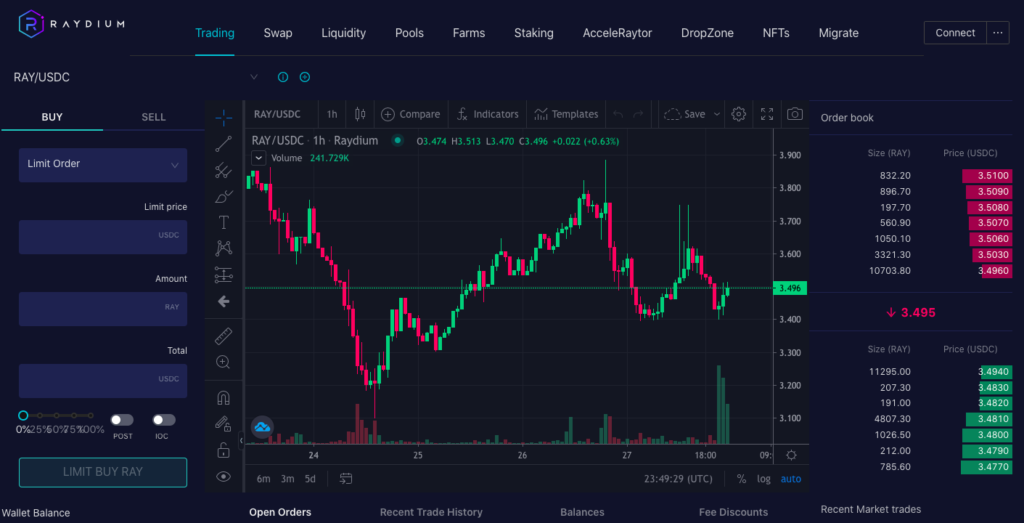

Raydium also gives you the option of placing limit orders, in which you can set a price limit for the trade you want to make. In this case trades are only executed if the exchange is able to match your price limit.

Staking

Raydium also allows users holding RAY tokens to stake them through the exchange and earn additinal RAY tokens as a reward. You can easily take part in staking using Raydium’s interface from the Stake tab. All you have to do is connect your wallet, select the amount you wish to stake and complete the transaction.

Yield Farming

Yield farming is a crypto investment alternative that enables participants to generate a passive income. Raydium also allows you to participate in yield farming through its Raydium farms. When you provide liquidity to a Raydium Farm, you earn RAY tokens as a reward. You also receive a share of the pool’s corresponding trading fees.

Raydium Fusion Pools

Fusion Pools are somewhat similar to Raydium Farms, however liquidity providers earn project tokens rather than RAY rewards. You can also earn trading fees contributed to the pool.

Is Raydium Safe?

Raydium, like other decentralized exchanges, offers users a higher level of security compared to centralized exchanges. Your assets are kept in your full custody, safeguarded by your cryptowallet, while Raydium only processes the transactions you complete. Since assets are kept individually by each user, Raydium is not an attractive target for hackers. Plus, all transactions are approved from your end using your linked wallet.

Raydium Pros

- Affordable: Raydium runs on Solana which results in cheap gas and trading fees for its users.

- Liquidity: Users can take part in crypto trading taking advantage both of Raydium’s liquidity books and Serum’s orderbook.

- User-friendly: The Raydium interface is intiuitive and easy to navigate, and offers a wide range of features for crypto trading and investing.

Raydium Cons

- No fiat: Central exchanges allow users to trade cryptocurrencies and fiat, however Raydium doesn’t support this functionality. It can only be used to swap crypto pairs.

Is Raydium DEX Right For You?

Raydium is a good option to consider if you are looking for a decentralized exchange that is able to offer some of the advantages of order book based trading. Since it runs on the Solana network, it also provides a fast trading experience with low trading fees.