Cryptocurrency scams are on the rise, as scammers are increasingly targeting people who are interested in investing in or using cryptocurrencies. Cryptocurrency scams can take many forms, but they all share the common goal of tricking people into sending money or revealing their personal information.

Let’s be clear. If you believe that individuals who fall prey to scams are gullible, reconsider your perspective. Scammers continually devise new tactics that can catch anyone off guard, making it possible for anyone to become a victim. Therefore, it’s essential to stay vigilant by researching scams regularly, staying informed about their latest strategies, and scrutinizing any seemingly extraordinary opportunities. The cardinal rule remains: if an offer appears too good to be true, it likely conceals a scam.

Here are some tips on how to avoid cryptocurrency scams:

- Never give out your private cryptocurrency keys. Your private keys are like the passwords to your cryptocurrency wallets. If you give them to someone, they will be able to steal your cryptocurrency.

- Be wary of investment opportunities that promise high returns with low risk. There is no such thing as a guaranteed investment, and any investment that promises high returns with low risk is likely to be a scam.

- Don’t click on links in emails or on social media from people you don’t know. These links could lead to phishing websites that are designed to look like legitimate cryptocurrency websites.

- Be suspicious of unsolicited offers of help. If someone contacts you out of the blue to offer help with your cryptocurrency, it is likely a scam.

- Do your research before investing in any cryptocurrency. Before you invest in any cryptocurrency, take the time to learn about the project and the team behind it. Read white papers, check out social media communities, and look for reviews from other investors.

Here are some specific types of cryptocurrency scams to be aware of:

Pump-and-dump cryptocurrency scams:

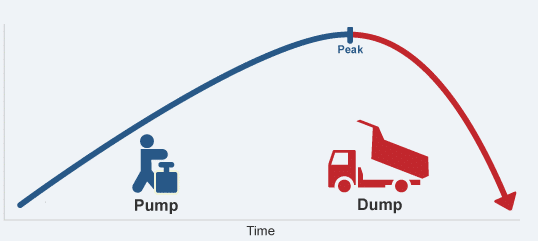

Cryptocurrency markets, while promising lucrative opportunities, are not immune to manipulation and deceit. Among the various schemes that have emerged, the pump-and-dump scam stands out as a cunning strategy to exploit unsuspecting investors.

What is a Pump-and-Dump Scheme?

A pump-and-dump scheme involves artificially inflating the price of a cryptocurrency through misleading information and hype. The orchestrators, often operating in coordinated groups, strategically buy large quantities of low-value cryptocurrency. Subsequently, they disseminate positive rumors and create a buzz around the coin, luring other investors into buying in and driving up the price.

Once the price reaches an artificially inflated peak, the perpetrators swiftly sell off their holdings, leaving latecomers with devalued assets. This sudden “dump” results in significant financial losses for those who bought in during the hype, while the scammers walk away with ill-gotten gains.

Red Flags of Pump-and-Dump Schemes:

- Unrealistic Promises: Be wary of investments promising astronomical returns within an implausibly short timeframe. Such assurances often precede pump-and-dump schemes.

- Aggressive Marketing Tactics: Pump-and-dump organizers often employ aggressive marketing strategies, flooding social media platforms and online forums with exaggerated claims to attract investors.

- Sudden Surge in Price: If a relatively obscure cryptocurrency experiences an abrupt and unnatural surge in price, exercise caution. Such spikes may be indicative of a pump-and-dump in progress.

- Lack of Fundamental Value: Research the underlying fundamentals of a cryptocurrency before investing. Pump-and-dump schemes typically involve coins with little to no intrinsic value.

Protecting Yourself Against Pump-and-Dump Scams:

- Due Diligence: Conduct thorough research on any cryptocurrency before investing. Scrutinize the project’s whitepaper, team members, and community feedback to assess its legitimacy.

- Stay Skeptical: Maintain a healthy skepticism, especially in the face of unsolicited investment tips or overly optimistic promises. If it sounds too good to be true, it probably is.

- Avoid FOMO (Fear of Missing Out): Resist the urge to invest hastily based on market hype. Take the time to evaluate investment opportunities carefully.

- Diversify Your Portfolio: Diversification can help mitigate the impact of losses from individual investments. A well-balanced portfolio is less susceptible to the risks associated with pump-and-dump schemes.

Exit Cryptocurrency scams:

In an exit scam, the creators of a cryptocurrency project simply disappear with investors’ money. This can happen if the project is a scam from the start, or if the creators simply decide to abandon the project.

What is an Exit Cryptocurrency Scam?

An exit scam occurs when the creators of a cryptocurrency project abruptly vanish, taking with them the investments made by unsuspecting participants. Unlike other scams that involve market manipulation or deception, exit scams involve a blatant and sudden abandonment of the project, leaving investors in the dark and empty-handed.

Key Characteristics of Exit Cryptocurrency Scams:

- The disappearance of Developers: The primary red flag in an exit scam is the sudden disappearance of the cryptocurrency project’s developers and key team members. They cut off communication channels, leaving investors without any updates or recourse.

- Ceased Operations: Projects associated with exit scams often cease all operations abruptly. Websites go offline, social media accounts are deactivated, and any semblance of project activity grinds to a halt.

- Unrealistic Promises: Exit scams may involve creators making grand promises and commitments to investors, only to vanish when it’s time to deliver. Unrealistic assurances should be a cause for concern.

- Lack of Transparency: Projects involved in exit scams often lack transparency from the outset. Limited information about the team, unclear project goals, and ambiguous roadmaps can be indicative of fraudulent intentions.

Protecting Yourself Against Exit Scams:

- Thorough Research: Before investing in any cryptocurrency project, conduct extensive research. Verify the credentials of the team members, scrutinize the project’s whitepaper, and seek out reviews and feedback from reputable sources.

- Community Feedback: Engage with the cryptocurrency community and seek feedback from other investors. Shared experiences and warnings from those who have encountered suspicious projects can be valuable in avoiding exit scams.

Cryptocurrency Phishing Scams:

Cryptocurrency phishing scams have emerged as a persistent and insidious threat in the ever-expanding digital landscape. Employing deceptive tactics, these scams aim to trick individuals into revealing sensitive information, such as cryptocurrency wallet passwords or private keys. Phishing can manifest in various forms, including fake emails, websites, and even phone calls, where scammers pose as legitimate entities to lure unsuspecting victims into divulging their credentials. The sophistication of these schemes often makes it challenging for users to distinguish between authentic communication and fraudulent attempts, underscoring the need for heightened awareness and proactive measures.

Recognizing the Warning Signs:

Phishing scams in the cryptocurrency realm often rely on urgency and false pretenses. Users should be wary of unsolicited communications offering assistance or claiming issues with their accounts, prompting them to click on links that lead to fraudulent websites designed to mimic legitimate platforms. A fundamental rule to follow is never to share sensitive information via unsecured channels, and users must verify the legitimacy of any communication before taking any action. By staying informed, employing security best practices, and fostering a skeptical mindset, individuals can fortify themselves against the pervasive threat of cryptocurrency phishing scams in an increasingly digital world.

Fake cryptocurrency exchanges:

Fake cryptocurrency exchanges are designed to steal people’s cryptocurrency. If you are considering using a new cryptocurrency exchange, be sure to research it carefully before depositing any funds.

The rise of cryptocurrencies has spawned a thriving ecosystem of exchanges, providing users with platforms to buy, sell, and trade digital assets. However, within this burgeoning landscape, a nefarious player has emerged – the fake cryptocurrency exchange. These deceptive platforms are designed with the sole purpose of siphoning off users’ hard-earned funds. Unwary investors may be enticed by promises of low fees, attractive trading interfaces, and seemingly lucrative opportunities, only to fall victim to a well-orchestrated scam.

Red Flags and Tactics:

Fake cryptocurrency exchanges employ a variety of tactics to deceive users. They may replicate the interfaces of legitimate platforms, luring investors with familiarity. However, upon closer inspection, discerning users may notice subtle differences or irregularities. These fraudulent exchanges may also engage in aggressive marketing, promising unrealistically high returns or exclusive opportunities to attract unsuspecting victims. To avoid falling prey to these scams, exercise caution, conduct thorough research on any exchange you consider using, and remain skeptical of offers that seem too good to be true.

Protecting Your Investments:

As the cryptocurrency market continues to evolve, safeguarding one’s investments becomes paramount. To protect against fake exchanges, you should prioritize established and reputable platforms with a proven track record. Conducting due diligence, such as researching user reviews and ensuring the exchange complies with regulatory standards, can significantly reduce the risk of falling victim to a fraudulent scheme. Moreover, staying informed about common tactics used by fake exchanges and remaining vigilant in the face of unsolicited offers can empower investors to make sound decisions, fortifying themselves against the pervasive threat of fake cryptocurrency exchanges in the dynamic and sometimes treacherous world of digital assets.

You May Also Like: Safeguarding Your Investments in Pools and Swaps: Avoiding Malicious Smart Contracts

If you think you may have been the victim of a cryptocurrency scam, there are a few things you can do:

- Report the scam to the authorities. You can report cryptocurrency scams to the police, the Federal Trade Commission (FTC), and the Securities and Exchange Commission (SEC).

- Contact the cryptocurrency exchange where you lost your funds. Some cryptocurrency exchanges may be able to help you recover your stolen funds.

- Change your cryptocurrency wallet passwords. If you think your cryptocurrency wallet passwords may have been compromised, change them immediately.

By following these tips, you can help protect yourself from cryptocurrency scams. Remember to always be wary of unsolicited investment opportunities, and never give out your private keys.