Ethereum, introduced by Vitalik Buterin in 2015, revolutionized the landscape of blockchain technology by introducing smart contracts and decentralized applications (DApps). Unlike its predecessor Bitcoin, which primarily serves as a digital currency. Ethereum serves as a decentralized platform that enables developers to build and deploy smart contracts and DApps.

In this comprehensive guide, we will delve into the intricacies of Ethereum blockchain. Exploring its architecture, consensus mechanism, smart contracts, decentralized finance (DeFi), scalability challenges, and future prospects.

Understanding Blockchain Technology:

To comprehend Ethereum blockchain, it’s essential to grasp the fundamentals of blockchain technology. At its core, a blockchain is a distributed ledger that records transactions across a network of computers. Each block in the blockchain contains a cryptographic hash of the previous block, forming a chain of blocks, hence the term blockchain. This immutable and transparent nature of blockchain ensures trust and security in transactions without the need for intermediaries.

Ethereum Blockchain Architecture

The Ethereum blockchain architecture comprises a decentralized network consisting of nodes. Each of which stores a complete copy of the blockchain ledger. These nodes play a pivotal role in maintaining the integrity and security of the network by participating in the validation and propagation of transactions. Proof of Work (PoW) serves as the algorithm at the core of Ethereum’s consensus mechanism. Aimed at achieving agreement on the state of the blockchain. In this model, nodes engage in competition to solve complex cryptographic puzzles. With the first node successfully solving the puzzle earning rewards in the form of newly minted Ether and the privilege to append a new block to the blockchain. However, PoW has faced criticisms for its energy-intensive nature and scalability limitations.

Tackling Challenges

In response to these challenges, Ethereum upgraded to Ethereum 2.0, which involves transitioning from PoW to Proof of Stake (PoS). In the PoS model. Validators earn the responsibility to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. This transition aims to improve the scalability, security, and sustainability of the Ethereum network. While reducing its energy consumption and carbon footprint.

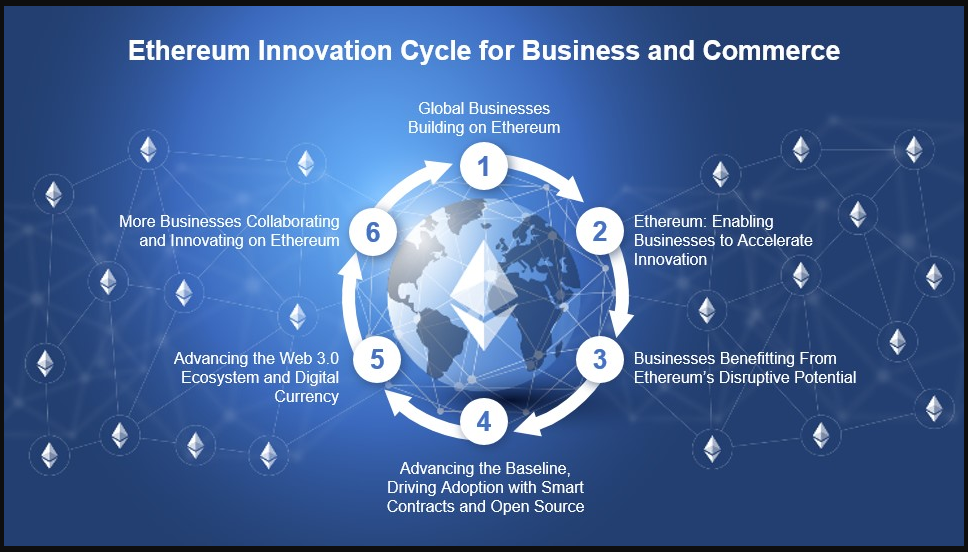

Central to Ethereum’s functionality is the Ethereum Virtual Machine (EVM), a Turing-complete runtime environment that enables the execution of smart contracts. Smart contracts are self-executing agreements coded in languages such as Solidity and deployed on the Ethereum blockchain. The EVM ensures the precise execution of these contracts as programmed. Providing a trustless and immutable platform for executing decentralized applications (DApps) and facilitating peer-to-peer transactions without requiring intermediaries. This innovative architecture empowers developers to create a wide range of decentralized applications. From decentralized finance (DeFi) platforms to supply chain management solutions, ushering in a new era of decentralized innovation and collaboration.

Ethereum Blockchain Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Once developers deploy smart contracts on the Ethereum blockchain. These contracts automatically execute when predefined conditions are met, eliminating the need for intermediaries. Smart contracts facilitate a wide range of applications. Including decentralized finance (DeFi), supply chain management, decentralized autonomous organizations (DAOs), and more.

Decentralized Applications (DApps)

Decentralized Applications (DApps) leverage the decentralized and immutable nature of blockchain technology, serving as applications built on top of it. Ethereum hosts a myriad of DApps across various sectors, including finance, gaming, social networking, and identity management. These DApps offer enhanced security, transparency, and censorship resistance compared to traditional centralized applications.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a revolutionary subset of decentralized applications (DApps) that aims to transform traditional financial services using blockchain technology. Unlike traditional finance. Which relies heavily on intermediaries such as banks and exchanges. DeFi protocols leverage the inherent characteristics of blockchain to provide financial services in a trustless and permissionless manner. These services encompass lending, borrowing, trading, and asset management, among others.

One of the key advantages of DeFi is its accessibility. By eliminating intermediaries. DeFi platforms enable anyone with an internet connection to access financial services, regardless of their geographical location or socioeconomic status. This democratization of finance potentially empowers millions of individuals underserved or excluded by the traditional banking system.

Ethereum’s flexibility and programmability make it the preferred platform for DeFi innovation. Ethereum’s support for smart contracts allows developers to create complex financial instruments and protocols that operate autonomously without the need for human intervention. Projects like Uniswap, a decentralized exchange (DEX) that enables users to trade cryptocurrencies directly from their wallets. Compound, a decentralized lending protocol, and MakerDAO, a decentralized stablecoin platform, have gained widespread adoption within the DeFi ecosystem.

Ethereum Success

The success of these projects highlights the growing demand for decentralized financial services and the potential of blockchain technology to disrupt traditional finance. However, DeFi is still in its nascent stages and faces several challenges, including scalability, security, and regulatory uncertainty. Scalability issues, such as network congestion and high gas fees on the Ethereum blockchain, can hinder the adoption of DeFi applications and limit their potential impact.

Despite these challenges, the DeFi ecosystem continues to grow rapidly, attracting investment from both retail and institutional players. As the infrastructure supporting DeFi matures and developers implement scalability solutions. DeFi has the potential to emerge as a mainstream alternative to traditional finance. Offering greater financial inclusion, transparency, and efficiency for users worldwide.

Ethereum Scalability Challenges

Despite its groundbreaking features, Ethereum faces scalability challenges, especially concerning transaction throughput and network congestion. The surge in DeFi activity has strained the network, leading to high gas fees and slower transaction processing times. Ethereum 2.0, a major upgrade aimed at improving scalability and transitioning to PoS. Promises to address these issues through solutions like sharding and the Beacon Chain.

Ethereum 2.0 Blockchain Upgrade

The upgrade, also known as Eth2 or Serenity, represents a significant upgrade aimed at enhancing Ethereum’s scalability, security, and sustainability. The upgrade introduces PoS consensus mechanism, replacing energy-intensive PoW, and implements shard chains to parallelize transaction processing. The Beacon Chain, launched in December 2020, serves as the backbone of Ethereum 2.0, coordinating validator nodes and managing the PoS consensus.

Future Prospects

Despite the challenges. Ethereum remains at the forefront of blockchain innovation, continuously evolving to meet the demands of decentralized applications and DeFi. The successful rollout of Ethereum 2.0 positions the platform to achieve greater scalability and throughput. Thereby paving the way for mainstream adoption and transformative use cases across industries.

You May Also Like: Bitcoin Blockchain

Conclusion

Ethereum blockchain stands as a testament to the transformative potential of decentralized technologies, enabling a new paradigm of trustless, transparent, and permissionless applications. Additionally, as Ethereum continues to evolve and overcome scalability challenges. It holds the promise of revolutionizing not just finance but various aspects of our digital lives, ushering in a decentralized future powered by smart contracts and DApps.