In the ever-evolving world of cryptocurrencies and blockchain technology, Decentralized Finance (DeFi) has emerged as a revolutionary way to manage and grow your digital assets. One of the key features of DeFi is the ability to swap and pool tokens to earn rewards or access various financial services. However, navigating this landscape safely requires knowledge and caution. In this comprehensive guide, we will break down the essential steps to ensure that the swaps and pools you engage in are secure, even if you’re new to DeFi.

Understanding the Basics

Before we dive into the safety measures, let’s establish some fundamental concepts:

What are DeFi Swaps and Pools?

DeFi swaps refer to the process of exchanging one cryptocurrency for another without the need for intermediaries like traditional banks or centralized exchanges. Pools, on the other hand, involve contributing your assets to a shared liquidity pool, allowing others to swap between tokens, and earning rewards in return.

Pools are from the concept of voluntary contributions by groups of people. Even before the internet, people used to do pools by contributing money and giving to each other in turns, this by then was done by groups of people who trust each other. Today this trust is put in place using the blockchain.

However, there are still issues that you should look out for when joining a pool, and we will be sharing the most important measures that will help you protect yourself.

Safety Measures for DeFi Swaps and Pools

Now, let’s explore how to verify the safety of swaps and pools, step by step:

1. Choose Trusted Platforms

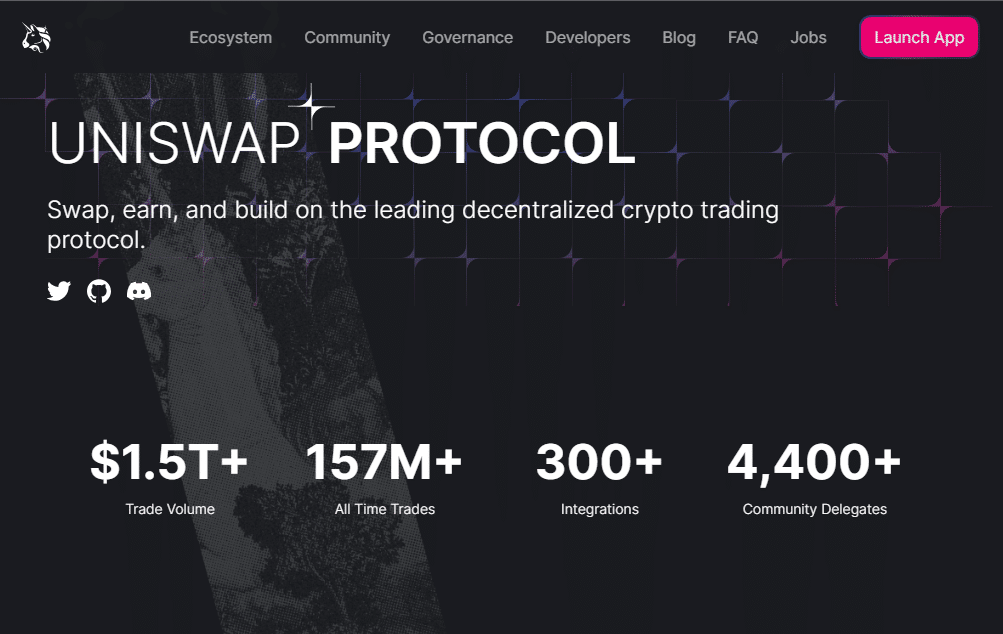

Start by selecting well-known and reputable DeFi platforms. Popular decentralized exchanges (DEXs) such as Uniswap, SushiSwap, PancakeSwap, and Curve Finance have established themselves as trustworthy options.

2. Verify the Website URL

Scammers often create fake websites that closely mimic the appearance of legitimate platforms. Always double-check the URL to ensure you are on the official website of the DEX you want to use.

3. Confirm the Contract Address

Each liquidity pool or token on DeFi has a unique contract address. Verify the contract address on the official website, community forums, or blockchain explorers to ensure it’s legitimate.

4. Review Token Information

Before participating in a swap, take a moment to research the token. Verify that it belongs to a genuine project with a clear use case. Be cautious when dealing with unfamiliar or newly launched tokens.

5. Check Liquidity and Volume

High liquidity and trading volume indicate a healthy and safer liquidity pool. A pool with more liquidity typically provides better prices and fewer price fluctuations. You may get this information on the home page or search on the web.

6. Double-Check Addresses and Data

Before confirming a swap, double-check wallet addresses and transaction details. A small mistake in an address can lead to irreversible losses.

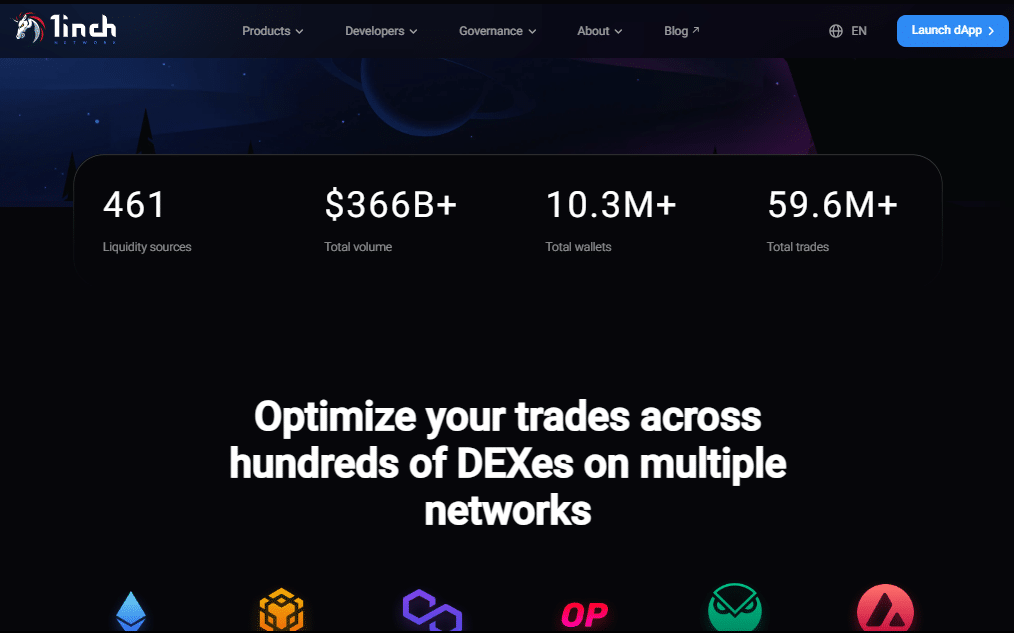

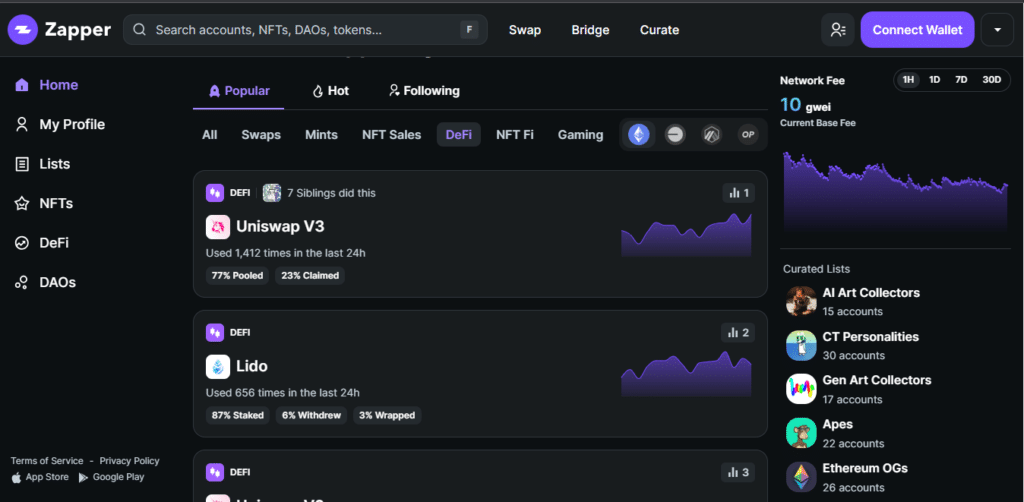

7. Utilize DeFi Aggregators

DeFi aggregators like Zapper can help you find the best swap routes and provide valuable information about liquidity pools. They often display essential metrics and data from various DEXs.

8. Watch for Slippage

Slippage refers to the difference between the expected price of a trade and the actual executed price. Be aware of slippage, especially for large transactions, and adjust your settings accordingly to avoid unexpected losses.

9. Consider Gas Fees

Keep an eye on gas fees associated with your swap. High gas fees can impact the profitability of a swap, particularly for small transactions.

10. Avoid Unfamiliar Tokens

Stick to tokens with established reputations. Avoid swapping for unfamiliar or newly launched tokens, as they may carry higher risks.

11. Seek User Feedback

Look for user reviews and feedback on forums, social media, or community platforms related to DeFi. Learning from the experiences of others can provide valuable insights.

12. Secure Your Wallet

Use secure wallets like hardware wallets or well-known software wallets. Be cautious about granting permissions to unknown apps or websites.

13. Start Small

If you’re unsure about a swap or pool, start with a small test transaction. This allows you to become familiar with the process and minimize potential losses.

14. Examine the Smart Contract Code

If you have technical expertise, consider reviewing the smart contract code of the liquidity pool.

Also Read: Safeguarding Your Investments in Pools and Swaps: Avoiding Malicious Smart Contracts

It’s important to remember that In the exciting world of DeFi, you can take control of your financial assets like never before. However, safety must always be a top priority. By following these steps and staying informed, you can confidently engage in swaps and liquidity pools while minimizing risks. Remember, the key to a successful DeFi journey is continuous vigilance, prudent decision-making, and learning.