Back in 2017 the IRS sued Coinbase. Why? The IRS believed many people with cryptocurrency gains weren’t filing their tax returns. I think they were right. For the 2015 tax year, the IRS said only 802 tax returns were filed showing bitcoin gains. I’m sure there were many more that should have filed, but not everyone believes in paying taxes.

So, the IRS subpoenaed the largest US based crypto exchange, Coinbase, with the intention of gaining access to their customer database. The IRS wanted to know names of customers, how much money was in their accounts, details of their trading activity, and more. Coinbase said no, so the IRS sued them.

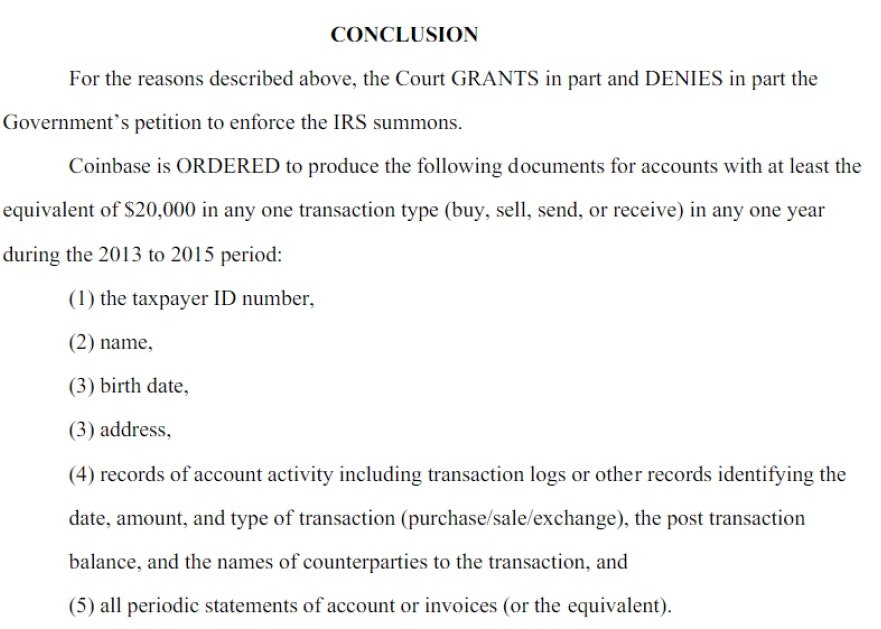

So, who won?! Well, they both kinda won. The courts agreed the IRS could get some information about Coinbase customers, but not as much as the IRS wanted. Coinbase had to turn over data on about 13,000 of its roughly 2 million customers. These were folks who moved $20,000 worth of crypto at any one time.

Keep in mind the lawsuit that the IRS won back in 2017 was for activity that happened in between 2013-2015. Going forward Coinbase, and probably other US exchanges, is required to report the total dollar amount traded by certain account holders. These amounts are reported on a 1099-K. If you or someone you know received a 1099-K because they traded cryptocurrencies, don’t panic! It’s only telling you how much in total value you traded throughout the year, not your profit. But be sure to find a tax professional that can help you report your capital gains and losses on your return. Because the IRS also received a copy of your 1099-K, which means they are expecting a tax return from you.

Below is a screenshot of the lawsuit final conclusion plus a PDF of the actual ruling.

Buy Crypto On Coinbase